Enhancing Rule Engines with Syncloop: Integrating Business Logic and APIs

Posted by: Muheet | September 26, 2024

In an era characterised by rapid technological advancements and dynamic business environments, organisations constantly seek innovative ways to streamline operations and enhance decision-making capabilities. Rule engines have emerged as indispensable tools in this context, enabling enterprises to execute complex business logic and automate crucial decisions based on predefined rules. Traditional rule engines, however, often face limitations in terms of flexibility, scalability, and integration with external systems. Enter Syncloop—a cutting-edge platform that revolutionises how rule engines operate by seamlessly integrating business logic with APIs. This blog explores how Syncloop enhances rule engines and drives better business outcomes.

Understanding Rule Engines

Before delving into Syncloop's transformative potential, it's essential to grasp the core concept of rule engines. A rule engine is a software system that executes business rules in a runtime environment. These rules follow an "if-then" logic, allowing the system to automate decision-making processes based on predetermined criteria. The primary components of a rule engine include:

- Rules: Conditionally defined actions based on facts.

- Facts: Information pieces evaluated against rules.

- Inference Engine: The core component that processes facts and applies relevant rules.

- Rule Repository: Stores rules separately from application code, enabling easy modifications.

Rule engines are extensively used across industries, including finance, healthcare, e-commerce, and logistics, to automate loan approvals, fraud detection, and inventory management processes. Despite their benefits, traditional rule engines often need help with limitations such as static rule sets and difficulty integrating with external APIs. This is where Syncloop emerges as a game-changer.

Introducing Syncloop

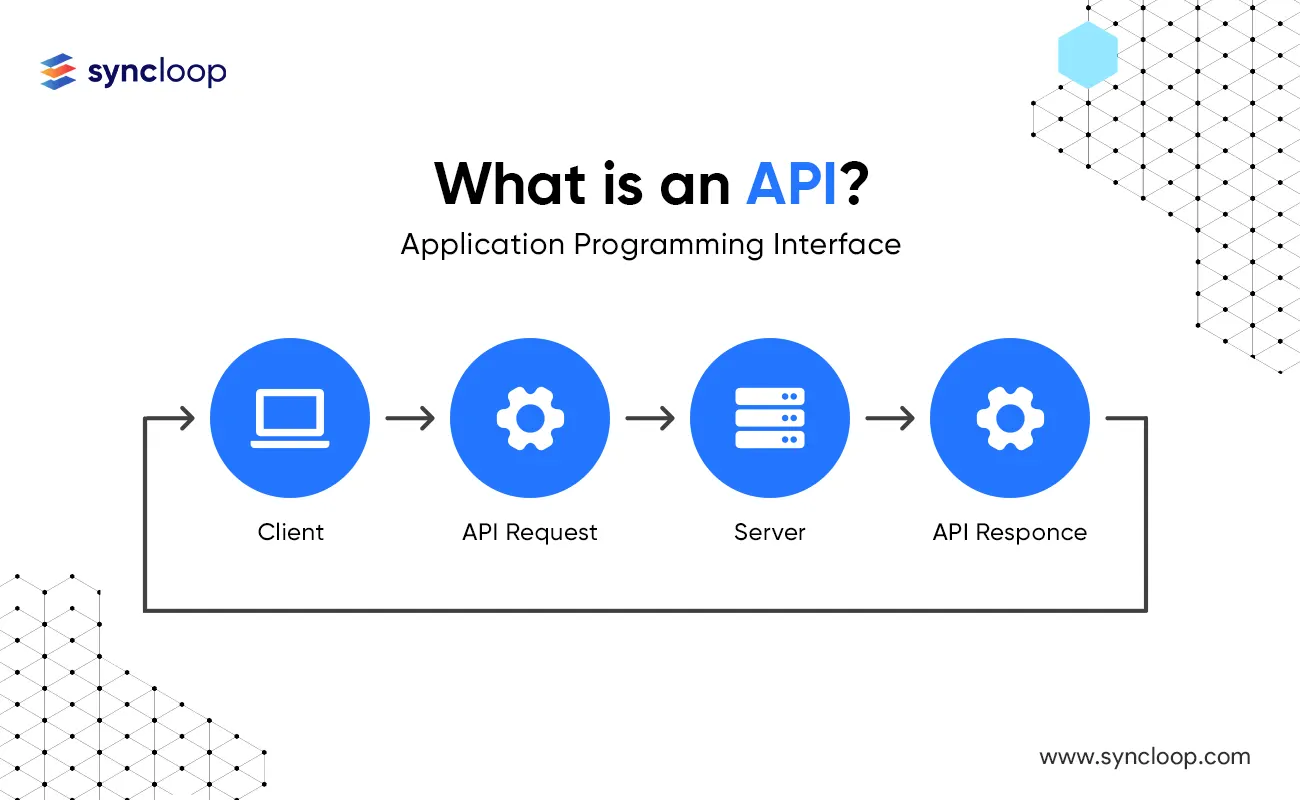

Syncloop is a revolutionary platform designed to enhance the capabilities of rule engines by seamlessly integrating business logic with APIs. This integration opens up a world of possibilities, enabling rule engines to access real-time data, interact with external systems, and dynamically adapt to changing conditions. Let's explore how Syncloop achieves this and the benefits it offers.

Real-Time Data Integration

One of Syncloop's most significant advantages is its ability to integrate real-time data into rule engines. Traditional rule engines rely on static data sets that may need to reflect the current state of the business accurately. Syncloop addresses this limitation by allowing rule engines to connect with real-time data APIs. This dynamic data integration ensures that decisions are based on the most up-to-date information, resulting in more accurate and timely outcomes.

For example, consider a retail company using a rule engine to manage inventory levels. By integrating Syncloop, the rule engine can access real-time stock data from the company's inventory management system. This allows the rule engine to make informed decisions about replenishment, promotions, and pricing based on current stock levels, sales trends, and supplier data.

Enhanced Flexibility and Scalability

Syncloop empowers rule engines with enhanced flexibility and scalability by enabling them to interact with various external systems. Traditional rule engines often need help to handle complex scenarios that require data from multiple sources. Syncloop's API integration capability overcomes this challenge by allowing rule engines to pull data from diverse systems, such as CRM, ERP, and IoT devices.

Consider a healthcare organisation using a rule engine to manage patient appointments. By integrating Syncloop, the rule engine can access patient data from the electronic health record (EHR) system, appointment schedules from the reservation system, and real-time traffic data from navigation APIs. This holistic view enables the rule engine to optimise appointment scheduling, minimise wait times, and enhance patient satisfaction.

Dynamic Rule Modification

In today's fast-paced business landscape, rules and criteria are constantly evolving. Static rule sets can quickly become outdated, leading to suboptimal decision-making. Syncloop addresses this issue by enabling dynamic rule modification through API interactions. This means that rule engines can automatically update their rules based on changing external conditions and data.

For instance, consider a financial institution using a rule engine for credit scoring. By integrating Syncloop, the rule engine can access real-time credit scores, economic indicators, and regulatory updates through APIs. This data allows the rule engine to adjust credit scoring criteria dynamically, ensuring lending decisions remain accurate and compliant with the latest regulations.

Streamlined Workflows and Automation

Syncloop enhances rule engines by streamlining workflows and automating complex processes. Traditional rule engines often require manual intervention to gather and process data from external systems. Syncloop's seamless API integration eliminates this manual effort, enabling rule engines to automatically retrieve and process data, trigger actions, and generate insights.

Consider an e-commerce platform using a rule engine for personalised product recommendations. By integrating Syncloop, the rule engine can access customer behaviour data from the CRM system, product information from the catalogue API, and real-time browsing activity from the website. This integration allows the rule engine to automatically generate personalised recommendations, improving customer engagement and driving sales.

Implementing Syncloop with Rule Engines

Implementing Syncloop with rule engines is a straightforward process that involves a few key steps:

- Identify Integration Points: Identify the external systems and APIs that must be integrated with the rule engine. This step involves mapping out the data sources and endpoints that will provide real-time data.

- Configure API Connections: Configure Syncloop to connect with the identified APIs. This involves setting up authentication, defining data mappings, and establishing communication protocols.

- Update Rule Sets: Modify the rule sets within the rule engine to incorporate the real-time data from Syncloop. This step may involve updating conditions, actions, and decision criteria based on the dynamic data.

- Test and Validate: Thoroughly test the integrated system to ensure that the rule engine accurately retrieves, processes, and applies real-time data. Validate the outcomes to ensure that the desired business objectives are achieved.

- Monitor and Optimize: Monitor the integrated system's performance and optimise the rule sets. This step involves fine-tuning the integration, analysing performance metrics, and adjusting based on changing conditions.

Case Study: Enhancing Loan Approval Processes

To illustrate Syncloop's transformative potential, let's consider a case study involving a financial institution's loan approval process. Traditionally, the institution relied on a rule engine to assess loan applications based on predefined criteria such as credit score, income, and debt-to-income ratio. However, the static nature of the rule sets often led to delays and inaccurate decisions.

By integrating Syncloop, the institution revolutionised its loan approval process. The rule engine was connected with APIs that provided real-time credit scores, income verification data, and fraud detection insights. Additionally, the rule engine accessed regulatory updates and economic indicators through Syncloop.

This integration yielded several benefits:

- Real-Time Decision-Making: The rule engine could instantly assess loan applications based on the most up-to-date credit scores and income data, resulting in faster and more accurate decisions.

- Dynamic Criteria Adjustment: The rule engine dynamically adjusted its criteria based on economic indicators and regulatory updates, ensuring compliance and minimising risk.

- Streamlined Workflows: Automated data retrieval and processing eliminated manual effort, allowing loan officers to focus on value-added tasks such as customer interactions and relationship building.

- Improved Customer Experience: Faster loan approvals and personalised offers based on real-time data enhanced the overall customer experience, leading to higher satisfaction and loyalty.

Conclusion

In conclusion, Syncloop represents a paradigm shift in how rule engines operate, empowering organisations to enhance decision-making, streamline workflows, and

Back to Blogs